Because There Can Be More To The Good Life, A Higher Level, A More Abundant Life -

From Mere Wealth To Prosperity

Wealth preserving economic insights make living the best of the good life prudent wealth management

YES Is Your Empowered Political Speech

Political Free Speech & Freedom are not free, but can be tax-friendly, cash flow positive, & profitable!

Tax Wise Political Giving

The provision of funds for political campaigns and election activities is not normally tax-deductible under the current tax code and election laws.

And they do not normally provide a measurable return on investment- unless you are illegally paying for political influence.

But these are NOT normal times?

That's why YES Yacht Executive Solutions created Your Empowered Speech and other Tax Wise Political Giving strategies.

How much more money might be raised, more quickly, and more easily for campaigns and other political activities, IF such financial support of political activities could at least be more tax-friendly - even if not directly tax-deductible themselves?

For anyone seeking or providing financial support for political causes, the YES Tax Wise political giving strategy is an obvious game changer- a superior method of enhanced political fundraising.

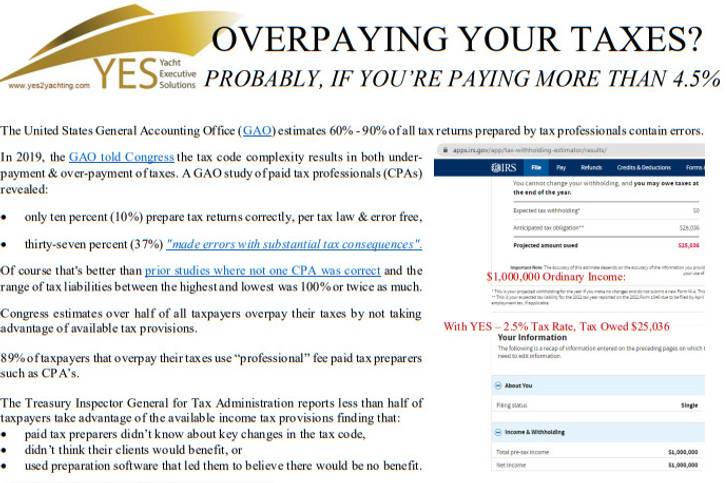

How much easier might it be to raise funds for political activities IF the financial supporters could pay less than 5% in combined state and federal taxes, rather than the 20%, 30% and over 50% that many political donors currently pay?

Many Have Not, Because They Ask Not

As for political non-profits; campaigns, 501(c)(4)s, PACS & Super PACS, etc., many may simply have not because they ask not.

Ask most CPA's, attorneys, or industry professionals about tax-deductible political donations and you'll likely get the same response about profitable boat ownership: "It can't be done".

But is that even the right question?

Perhaps they're not getting the right answer because few ask the right people the right question.

Three Examples Of Possible Contributor Scenarios

The "Right" Question Is Not Can It Be Done, But How Much Can Be Done

No Limits:

For federal elections, there is no cumulative or aggregate limit on the total amount a single person can contribute to all political candidates, political action committees (PACs), and party committees combined during an election cycle.

The Supreme Court's 2014 decision in McCutcheon v. FEC, ruled that aggregate limits on campaign contributions violate the First Amendment.

Super Strategy For Super PACs & Their Supporters:

There is no limit to how much an individual can donate to a Super PAC.

Super PACs (officially known as independent expenditure-only political committees) are distinct from traditional PACs in that they are permitted to accept unlimited contributions, provided they meet two conditions:

-

They do not make contributions directly to candidates or political party committees.

-

Their spending must be completely independent of any candidate's campaign and not coordinated with them in any way.

While contributions to Super PACs are unlimited, they are still subject to source restrictions; for example, they cannot accept money from foreign nationals, federal contractors, national banks, or federally chartered corporations. Super PACs are required to register with the Federal Election Commission (FEC) and disclose their donors periodically.

However, Individual Limits Still Apply To Per-Candidate and Per-Committee

Individuals must still adhere to specific limits for contributions to each recipient. For the 2025-2026 federal election cycle, an individual may contribute:

-

$3,500 per election to a federal candidate (the primary and general elections are considered separate elections, so a total of $7,000 per candidate per cycle is possible).

-

$5,000 per calendar year to any one PAC- that is not a Super PAC.

-

$44,300 per calendar year to a national party committee (e.g., the DNC or RNC main account).

-

$10,000 per calendar year to a state, district, or local party committee for its federal account.

State and Local Elections

Contribution limits for state and local elections vary by jurisdiction. Some states have their own limits on how much an individual can contribute to state-level candidates, while others, like Texas, have no limits at all for most state offices.

The Implications For Political Fundraising are Broad & Deep

What a significant competitive advantage for raising financial support for all types of political activities and for all types of political professionals and their supporters.

From Presidential campaigns to local candidates, from individual supporters to PACs and Super PACs, from first-time givers to political professionals and everything in between, YES Tax Wise Political Giving completely changes the dynamics of political giving.

This tax saving windfall - especially when combined with the new income from the invested tax savings - can significantly expand the universe of new political supporters.

Those who have given in the past are more likely to give substantially more, given the new income and tax savings.

And as long as one complies with the rules and regulations, there are few practical limits. In fact, donors can use the new income and tax savings to have an ever greater voice over more campaigns with little if any actual net capital expense.

Political donors can give more money, more often, and to many more candidates and still come out the financial winner!

That if your current advisors knew, surely they'd have told you already- wouldn't they?